Introduction

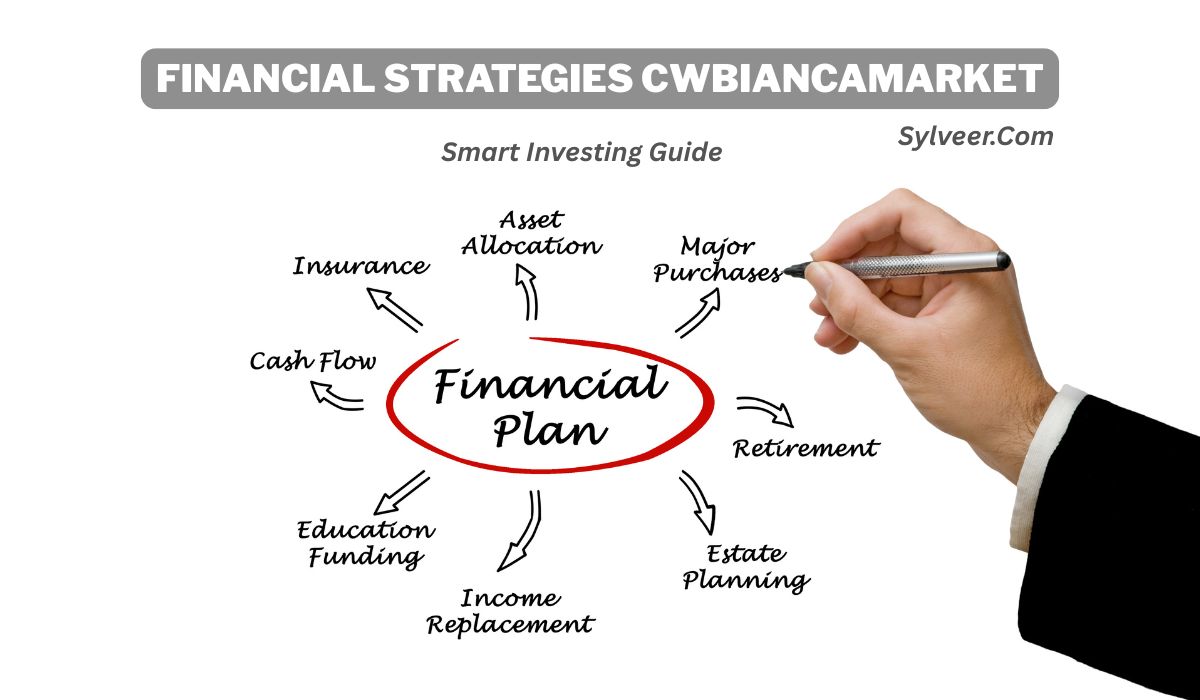

In today’s fast-changing financial world, having the right strategies is not optional — it’s essential. The keyword financial strategies CWBiancaMarket has gained attention among investors, entrepreneurs, and market watchers because it combines traditional financial planning with new-age digital market trends. Whether you’re managing personal wealth, building a startup, or trying to navigate global markets, understanding this concept can help you stay competitive and financially secure.

In this guide, we’ll break down what CWBiancaMarket means, why financial strategies linked to it are becoming important, and how you can apply them to your own financial journey.

What Is CWBiancaMarket in Financial Terms?

CWBiancaMarket is more than just a term; it represents a modern approach to financial ecosystems. Unlike traditional stock exchanges or banking systems, CWBiancaMarket refers to the integration of capital, wealth-building tools, and innovative market models in one framework. It blends financial technology, market analytics, and adaptive investment strategies to give individuals and businesses an edge.

In simple words, it’s a marketplace of opportunities that require smart financial strategies to unlock their full potential.

Why Financial Strategies CWBiancaMarket Matter Today

Markets no longer operate in silos. A decision made in one corner of the globe can affect stock prices, crypto assets, and business funding everywhere. That’s why financial strategies CWBiancaMarket are gaining relevance:

- Global Interconnectivity: Investors need strategies that account for shifts in international currencies, commodities, and digital assets.

- Digital Transformation: With fintech apps, AI-based trading, and blockchain solutions, new strategies are replacing outdated methods.

- Economic Uncertainty: Inflation, interest rates, and geopolitical events mean you can’t just “set and forget” your investments anymore.

According to a PwC report, 77% of financial leaders now prioritize adaptive strategies over rigid long-term planning. That shows how important a CWBiancaMarket-style approach is becoming.

Core Elements of Financial Strategies in CWBiancaMarket

1. Diversification with Intelligence

Diversification isn’t new, but in the CWBiancaMarket framework, it’s more data-driven. Instead of just splitting investments between stocks and bonds, investors now use tools like algorithmic insights to balance risk across sectors such as real estate, technology, green energy, and cryptocurrencies.

Example: A young investor might keep 40% in global equities, 20% in renewable energy startups, 20% in digital assets like Ethereum, and 20% in safe bonds.

2. Liquidity Planning

Cash flow is king. No matter how profitable an investment looks on paper, without liquidity, financial freedom is limited. Financial strategies CWBiancaMarket highlight short-term liquidity buffers to manage market shocks while keeping long-term capital growing.

Why it matters: During the 2020 pandemic crash, investors who kept 10–15% liquidity were able to buy quality assets at discounted prices.

3. Risk Management with Market Analytics

Old risk management used to be about simple stop-losses. Now, investors use real-time analytics, predictive modeling, and scenario testing. CWBiancaMarket strategies encourage using both macro (global economy) and micro (individual asset) data to build resilient portfolios.

Stat insight: According to Deloitte, companies that use predictive risk analytics outperform peers by 22% in average annual returns.

4. Sustainable and Ethical Investing

A unique part of CWBiancaMarket is the emphasis on ESG (Environmental, Social, Governance) criteria. Investors are no longer just chasing profits; they’re aligning portfolios with ethical growth. This trend is expected to dominate the next decade.

Real-world case: BlackRock, the world’s largest asset manager, reported that sustainable ETFs attracted over $120 billion in 2023 alone, proving this isn’t a niche trend anymore.

How to Apply Financial Strategies CWBiancaMarket Personally

Step 1: Define Your Goals

Ask: What are you investing for? Retirement, business expansion, or quick returns? Your CWBiancaMarket strategy depends on clarity of purpose.

Step 2: Embrace Technology

Use AI-driven apps, robo-advisors, and blockchain tools to optimize decision-making. These tools analyze data faster than human intuition.

Step 3: Build Flexible Portfolios

Unlike traditional “buy and hold” models, CWBiancaMarket strategies recommend dynamic portfolios that adjust with market signals.

Step 4: Stay Educated

Financial literacy is the backbone of success. Follow market reports, webinars, and expert insights. Remember, the strategies work only if you understand the logic behind them.

Expert Insights on CWBiancaMarket

Financial analysts suggest that the CWBiancaMarket represents a hybrid system of modern finance, where adaptability is more valuable than static planning. Dr. Elena Cruz, a financial strategist, explains:

“The strength of CWBiancaMarket strategies lies in flexibility. They allow investors to pivot quickly — from traditional bonds to digital assets — without losing sight of long-term goals.”

This mindset aligns with Warren Buffet’s famous principle: “Risk comes from not knowing what you’re doing.” CWBiancaMarket strategies ensure you’re always informed.

Future Outlook: Where Is CWBiancaMarket Heading?

Experts predict three major shifts:

- AI-First Investing: Most portfolio adjustments will be guided by AI by 2030.

- Cross-Market Integration: Cryptocurrencies, real estate, and stocks will merge into unified investment dashboards.

- Community-Driven Markets: Peer-to-peer investment platforms will challenge banks, giving individuals more power.

By preparing today, you can ride these waves instead of being swept away by them.

Conclusion

The concept of financial strategies CWBiancaMarket is more than just a buzzword — it’s a practical approach to modern wealth-building. It emphasizes flexibility, technology, ethical investing, and risk management, making it a powerful guide for individuals and businesses alike.

In a world of uncertainty, those who adopt adaptive strategies will thrive, while those clinging to outdated methods risk falling behind. The key takeaway? Stay informed, stay flexible, and let CWBiancaMarket strategies guide your financial decisions.

FAQs about Financial Strategies CWBiancaMarket

1. What does financial strategies CWBiancaMarket mean in simple terms?

It refers to modern, adaptable financial planning that blends traditional investing with new tools like AI, blockchain, and global market insights.

2. Why are financial strategies CWBiancaMarket different from traditional ones?

Traditional strategies focus on fixed plans, while CWBiancaMarket emphasizes flexibility, technology, and global awareness.

3. How can beginners start using CWBiancaMarket strategies?

Start small with diversified investments, use fintech tools for analysis, and focus on education. Over time, you can expand into more complex assets.

4. Are CWBiancaMarket strategies safe?

No strategy is risk-free, but CWBiancaMarket focuses heavily on risk management and liquidity buffers, which reduce exposure to big losses.

5. Can businesses benefit from financial strategies CWBiancaMarket?

Yes, businesses can use them for smarter budgeting, hedging risks, and accessing new markets like crypto financing or green bonds.

6. Is sustainable investing part of CWBiancaMarket?

Absolutely. ESG and ethical investing are at the core of CWBiancaMarket, ensuring long-term financial growth while supporting global causes.

7. What is the future of financial strategies CWBiancaMarket?

The future will see AI-driven, community-based, and cross-market investing platforms dominate. Being adaptable now ensures you’ll be ready for that shift.